What insurance do I need?

What insurance policies do you need?

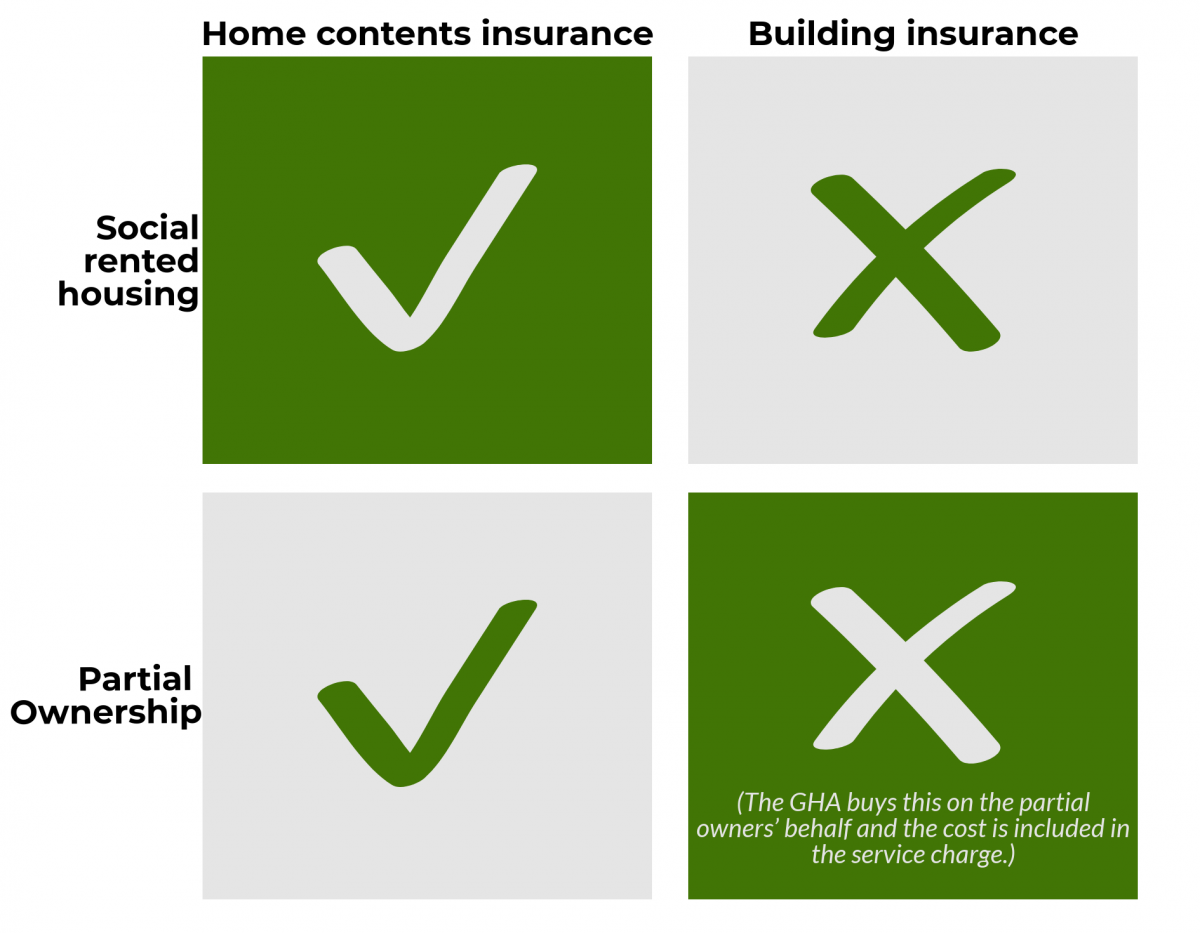

The GHA recommends that you have home contents insurance policy.

Buildings insurance covers the cost of repairing damage to the structure of a property and its fixtures caused by loss or damage due to fire, escape of water or storm for example.

If you are in a rented property, the GHA takes out a buildings insurance policy on your property which is recovered through the rent you pay each month.

If you are a partial owner, the GHA takes out a buildings insurance policy on your property, on your behalf, which is recovered through the service charge you pay each month. The amount you pay is much less than if you were to take out the policy yourself directly with an insurance company.

If you make significant improvements to your property, for example building a conservatory or installing a high-cost kitchen, then you will need to pay an additional premium to ensure you are covered to the full cost of the improvement. This will need to be done through GHA's building insurance policy and the additional costs recovered through your service charge.

Contents insurance covers the financial cost of repairing or replacing your household personal possessions and furnishings, such as curtains, furniture, white goods, stereo, TV, computers and other electrical appliances, clothing, jewellery, sporting equipment and even toys.

The GHA strongly encourages you to take out your own contents insurance. The GHA does not cover this. A number of companies are listed below.

Carpets are generally covered under contents insurance but wooden and laminate flooring is covered under the buildings insurance.

If you have to make a claim against the insurance policy, either buildings or contents, there may be an excess amount that you will have to pay. This amount varies dependent upon the type of claim and can be up to £500 for water damage.

Insurance companies will only pay out to cover damage caused by an event, but will not pay to repair or fix the original event.

For example, if your water cylinder split and the water flooded your property the insurance would cover the cost of any water damage and redecoration, but would not pay to repair or replace the split cylinder.

If you have a fire, flood or other event which damages your property or contents, you need to act immediately to stop the event damaging your property or contents further to ensure it is minimised and does not get any worse.

In the event of water damage, you should clear up the excess water immediately. If you need a professional trade you should call them as an emergency to ensure the event is contained and ensure there is no danger to people or the property.

You will be liable to settle the cost of this yourself. This cannot be claimed from your insurers.

For rental properties

To make a claim on your buildings insurance you should contact the maintenance department immediately to advise of the problem and to obtain a claim form.

Once you have completed it with as much detail as possible it should be returned to the Maintenance Department who will fill out the remaining sections on policy number etc. and pass to our insurance brokers.

Each claim will be assessed by the insurers and will be accepted or declined on the grounds of the limitations of the policy.

If it is a complicated claim, or expected to be a high value claim, the insurers will appoint a loss adjustor.

All rectification works will need to go through the appointed loss adjustor prior to work commencing. A loss adjustor will give approvals for temporary housing or other such decisions should they be necessary.

Please remember that if the claim for the building insurance was your fault, then you will be recharged the cost of the insurance excess to put it back to its previous condition. If the claim was due to wear and tear, then the GHA will cover the cost of the excess.

For partial owners

To make a claim on your buildings insurance you should contact the maintenance department immediately to advise of the problem and to request a claim form.

Once you have completed it with as much detail as possible it should be returned to the GHA who will fill out the remaining sections on policy number etc. and pass to our insurance brokers.

Each claim will be assessed by the insurers and will be accepted or declined on the grounds of the limitations of the policy.

If it is a complicated claim, or expected to be a high value claim, the insurers will appoint a loss adjustor. The loss adjuster will then contact you and it will be your responsibility to work with the insurance broker and the loss adjuster to put the property back into its original condition.

All rectification works will need to go through the appointed loss adjustor prior to work commencing. A loss adjustor will give approvals for temporary housing or other such decisions should they be necessary.

For a straightforward, lower cost claim, you should gain two quotations and submit them to the GHA who will pass on to the broker. Once the insurers have approved one of the quotations, you will be able to proceed with the works.

You will be required the pay the full cost of the insurance excess as per the terms of the insurance policy

The GHA is responsible for the following

- ensuring your property is covered by buildings insurance

- providing you with details of the insurance upon request

- providing you with a claim form upon request

- passing your completed claim form to the broker in a timely manner.

You are responsible for

- ensuring any high cost improvements are fully covered by insurance

- paying the cost of the insurance through your service charges (only for partial owners)

- paying the excess on any claim made against your property

- paying any trades or other professionals instructed to repair the original event

- completing the claim form in detail

- repairing the original event

- gaining two quotations for works being claimed, should no loss adjustor

be required - liaising with the loss adjustor, should one be appointed.

- gaining two quotations for works being claimed, should no loss adjustor

Insurance procedures for the following properties:

- A flat with a communal entrance, tenanted by a tenant on a tenancy or licence agreement and the property is unoccupied.

The tenant could be in hospital, prison or out of the island. If the tenant is away from the property for more than 30 days GHA will need to:

- Turn off water and gas (if applicable)

- Secure and lock all doors and windows (vents open)

- Close all internal doors

- Inspect/check on the property once a month*

- Ensure that all perishable foods are removed from the property including the fridge and kitchen cupboards

- Ensure all bins are emptied and refuse removed from property

- A house or flat with its own front door, tenanted by a tenant on a tenancy or licence agreement and the property is unoccupied.

If the tenant is away from the property for more than 30 days GHA will need to:

- Turn off the water and gas (if applicable)

- Secure and lock all doors and windows (vents open)

- Close all internal doors

- Inspect/check on the property once a month including the outside area*

- Ensure that all perishable foods are removed from the property including the fridge and kitchen cupboards

- Ensure all bins are emptied and refuse removed from property

*Inspection of the property (including turning off relevant supplies to the property) – If the maintenance department check a property that is unoccupied but under a tenancy agreement the tenant will be re-charged any costs incurred. The tenant can instruct a family member to carry out these checks. If this is the case GHA will need confirmation in writing/email that the family member will inspect the property monthly. There will be no separate charge for inspections carried out on occupied properties in Extra Care, these costs will be recovered through the service charge.

Insurance companies

Below are a number of leading companies on the island who will work with you to find the best deal for your specific requirements.

A partner of the GHA, La Fraternelle has provided contents insurance with a 10% discount for GHA tenants for four years. Remember to say that you are a GHA resident.

Call 728864

With over 60 years of industry experience in Guernsey, Oracle is one of the island’s expert brokers in ensuring you get the best deal to suit your circumstances.

Call 727347 or email [email protected]

Ross Gower Group has been providing insurance services in Guernsey since 1948 and is the only local company where you can pay directly online.

Call 722222 or email [email protected]

With an extensive range of products, the brokers at Cherry Godfrey can help protect your household items and treasured possessions at home and anywhere in the world.

Call 711666

Rossborough has been providing insurance services for 80 years and the team of brokers are always on hand to offer advice in person, online, or by phone.

Call 241555 or email [email protected]

Clegg Gifford has a wide range of house contents insurance available, ranging from basic contents to personal possessions.

Call 728987

Network Insurance state that they tailor each insurance policy to meet your specific needs. Following an enquiry, Network will establish your requirements and then liaise with its insurers to get tailored quotes on your behalf.

Call 701400.

Whatever your requirements, SPF ensures that time is taken to talk through the various options available and guide their clients every step of the way.

SPF Private Clients enjoys long-term relationships with many insurance clients due to their straightforward, knowledgeable and considerate approach.

Give them a call on 715234 or email [email protected]